All Categories

Featured

The youngster motorcyclist is bought with the idea that your child's funeral service expenses will certainly be completely covered. Kid insurance policy riders have a fatality advantage that ranges from $5,000 to $25,000.

Your kid needs to also be in between the ages of 15 days to 18 years of ages. They can be covered under this strategy up until they are 25 years of ages. Likewise, note that this policy only covers your youngsters not your grandchildren. Last expense insurance coverage benefits do not end when you sign up with a policy.

Cyclists are available in various types and present their very own advantages and motivations for joining. Motorcyclists deserve looking into if these supplementary options relate to you. Motorcyclists include: Faster death benefitChild riderLong-term careTerm conversionWaiver of costs The accelerated fatality advantage is for those that are terminally ill. If you are seriously ill and, depending on your certain policy, identified to live no more than 6 months to 2 years.

The Accelerated Death Benefit (for the most part) is not tired as revenue. The downside is that it's going to minimize the survivor benefit for your beneficiaries. Getting this also needs proof that you will certainly not live past six months to 2 years. The kid cyclist is acquired with the concept that your youngster's funeral expenses will be completely covered.

Insurance coverage can last up till the kid transforms 25. Additionally, note that you might not be able to authorize your youngster up if he or she experiences a pre-existing and serious condition. The long-lasting treatment cyclist is similar in principle to the sped up death benefit. With this one, the concept behind it isn't based upon having a short quantity of time to live.

Someone who has Alzheimer's and needs daily help from health and wellness assistants. This is a living advantage. It can be obtained against, which is extremely beneficial since long-term care is a substantial expenditure to cover. As an example, a year of having somebody take care of you in your home will cost you $52,624.

Last Expense

The reward behind this is that you can make the switch without being subject to a medical examination. final care expenses. And since you will no longer get on the term policy, this also implies that you no longer need to bother with outlasting your policy and shedding out on your fatality benefit

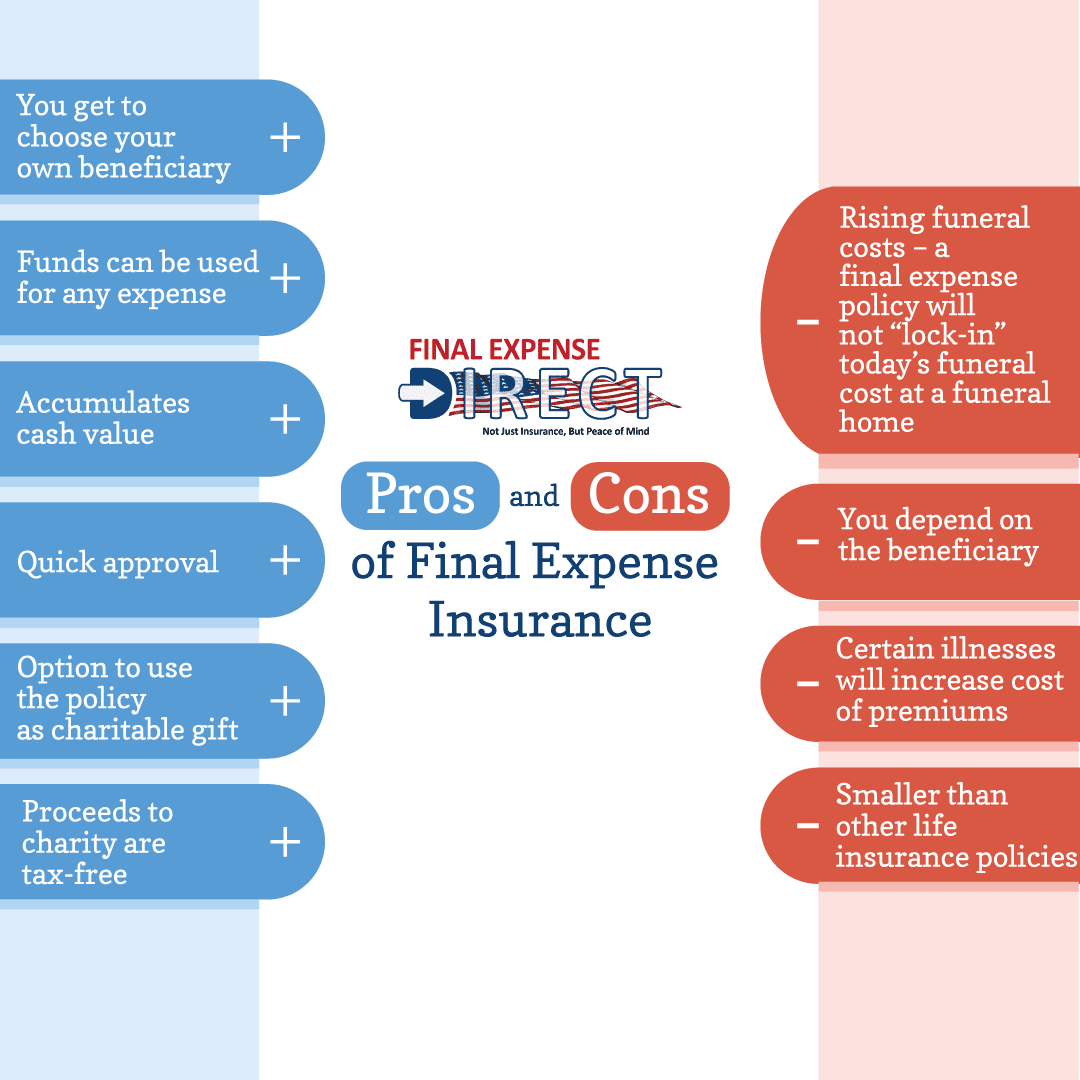

The specific quantity relies on different aspects, such as: Older people typically encounter greater costs as a result of boosted wellness risks. Those with existing health and wellness problems might experience greater costs or restrictions on insurance coverage. Greater protection amounts will naturally cause greater premiums. Bear in mind, policies usually top out around $40,000.

Take into consideration the regular monthly premium repayments, yet also the assurance and monetary protection it gives your household. For many, the reassurance that their loved ones will not be strained with economic challenge during a challenging time makes last cost insurance coverage a beneficial financial investment. There are two sorts of final expenditure insurance policy:: This kind is best for individuals in relatively excellent wellness who are searching for a way to cover end-of-life expenses.

Protection amounts for streamlined issue plans generally rise to $40,000.: This type is best for individuals whose age or health stops them from purchasing other types of life insurance policy protection. There are no health demands in all with assured problem policies, so any individual who meets the age needs can generally certify.

Funeral Costs Insurance

Below are some of the factors you need to take into consideration: Assess the application process for various plans. Make sure the provider that you choose supplies the amount of protection that you're looking for.

Latest Posts

Which Of The Following Best Describes Term Life Insurance

Short Term Life Insurance

Burial Insurance For Seniors Over 85